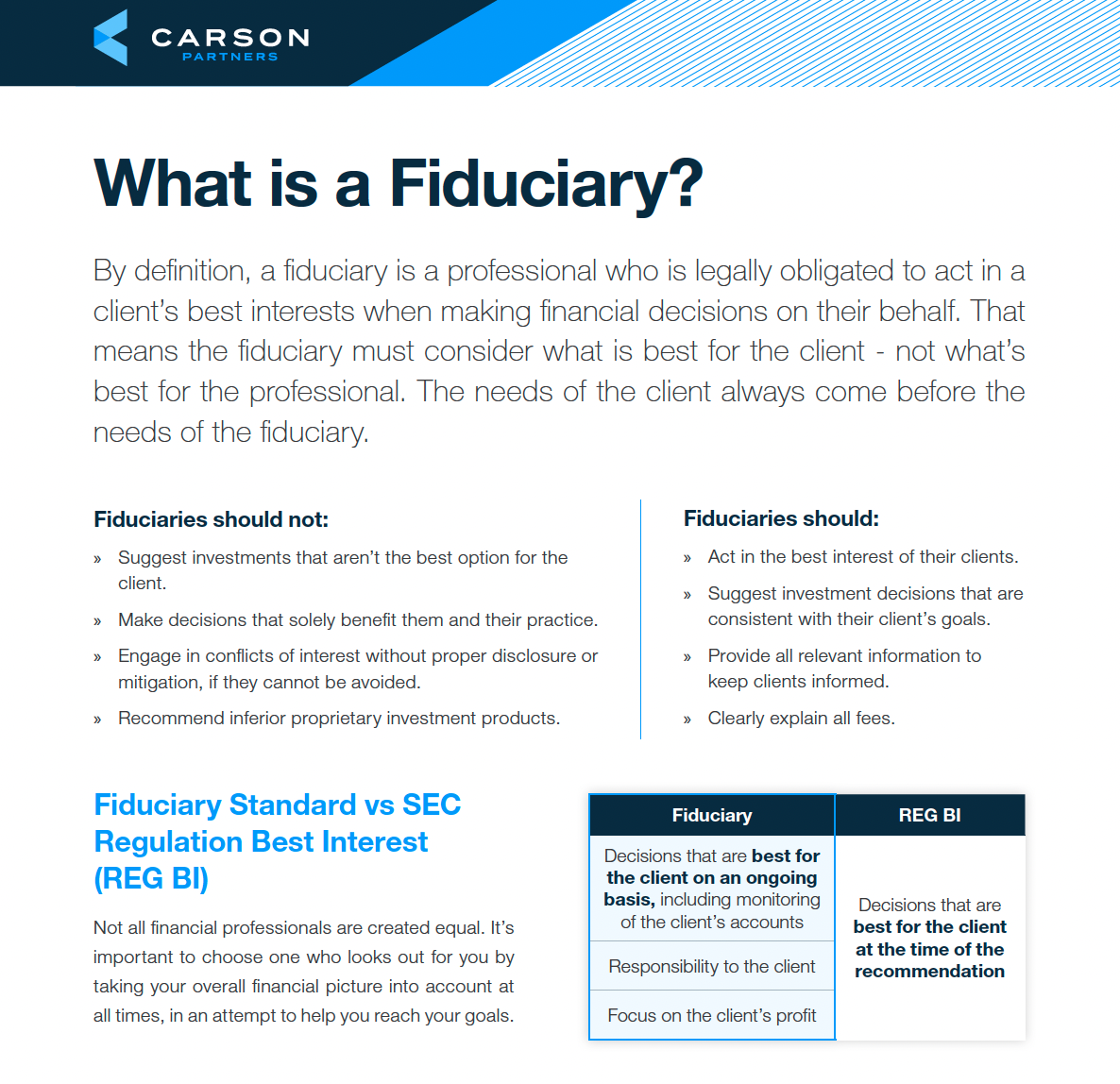

By definition, a fiduciary is a professional who is legally obligated to act in a client’s best interests when making financial decisions on their behalf. That means the fiduciary must consider what is best for the client – not what’s best for the professional. The needs of the client always come before the needs of the fiduciary.

Get in Touch

In just minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Contact UsLatest Posts

401(k) Calculator

Determine how your retirement account compares to what you may need in retirement.

Get StartedRelated Content

5 Reasons to Think About Long-Term Care Planning Today

I once received an email from a family friend about long-term care insurance. He was frustrated over a premium increase – which wasn’t the first rate hike – yet, he was still thankful for the policy. Despite the rising cost, he knew the importance of long-term care insurance in helping prot …

What is a Fiduciary?

By definition, a fiduciary is a professional who is legally obligated to act in a client’s best interests when making financial decisions on their behalf. That means the fiduciary must consider what is best for the client – not what’s best for the professional. The needs of the client …

Planning for Your First Required Minimum Distribution in Retirement

Mike Valenti, CPA, CFP®, Director of Tax Planning Qualified retirement plans – such as 401(k)s, 403(b)s and IRAs – offer clear tax advantages. Traditional 401(k)s, 403(b)s, and IRAs offer a tax deferral on contributions and growth until distribution. Their Roth counterparts can provide an i …

How to Leverage Tax-Advantaged Accounts in 2023

Kevin Oleszewski, CFP®, MST, EA, Senior Wealth Planner As you’re setting your new year’s goals, one that should top everyone’s list is increasing your savings. After all, we’ve recently seen inflation at work, reminding us that even everyday essentials can bust budg …

SECURE 2.0 Act Aims to Increase Retirement Savings for Americans

By Jamie Hopkins, Managing Partner, Wealth Solutions The SECURE 2.0 Act has passed, making it the largest retirement legislation since the original Secure Act hit in the late 2019.

Financial Resolutions to Take Into the New Year

Tom Fridrich, JD, CLU, ChFC®, Senior Wealth Planner Thinking about making some New Year’s resolutions? Add financial wellbeing to your list. It’s a terrific time to identify goals and opportunities that may put you in a better financial position — not only in the upcoming year, …

5 Charts Showing the Strength of the Labor Market

Last Friday, yet another strong payroll report was released with the headlines stating payrolls grew 263,000 in September and the unemployment rate fell to 3.5%.

7 Things to Know About the Historically Strong Fourth Quarter

“You make most of your money in a bear market, you just don’t realize it at the time.” —Shelby Cullom Davis We all blinked, and it is now October. This can be a good thing if you’re hoping for some higher stock prices. As this great quote by Shelby Cullom Davis above explains, it is …

Stop Overlooking These Valuable Workplace Benefits

Kevin Oleszewski, CFP®, Senior Wealth Planner It’s hard to fathom, but there are a lot of employee benefits that people aren’t using correctly — or aren’t using at all.

10 Answers to Questions About the Bear Market

2022 has been historically difficult for investors so far, and it’s likely you have questions. We’re here to answer some of the most common questions we’re hearing nowadays.